For the past couple of months, I’ve discussed the factors impacting our cooperative and dictating the need for adjustments to our rate structure. We’ve been able to operate without significant rate changes for nearly 15 years by actively managing costs, making efficiency improvements and maximizing technology. We have reached a point where it is no longer possible to meet our financial obligations and service expectations without increasing revenue.

A cost-of-service study conducted by an independent accounting firm found that a rate adjustment is needed to ensure the solid financial stability of our cooperative and maintain the reliability of our service. The primary factors driving the increase in costs include inflation, decreased revenue and decreased energy sales.

The impact of inflation

For families, inflation hits their budgets through higher prices at the grocery store, gas pump, and everything else you buy.

Since 2021, we have operated your electric system with only minor modifications to our charges. But during that time, the cost we pay to purchase power has increased by 21%, and the cost to operate and maintain our system has increased by 23%. Those costs are largely beyond our control.

The loss of revenue

Despite our best efforts to manage costs, the cost-of-service study found that our current rate structure only covers some of our expenses.

In 2023, Pioneer Electric collected 91% of our revenue requirement (the minimum amount of money we must collect to cover expenses). That would be the same as someone having monthly expenses of $1,000 and an income of $910.

Since 2021, our revenue requirement has increased by $5 million, while our energy sales have declined by 5 million kilowatt-hours during that same time. Additionally, there has been a loss of $1.1 million in annual revenue from large industrial loads that have shut down or reduced operations.

Combined, the increase in operating costs and decrease in revenue mean that we must collect an additional $3 million this year to meet our budget and our lenders’ requirements.

Cutting where we can

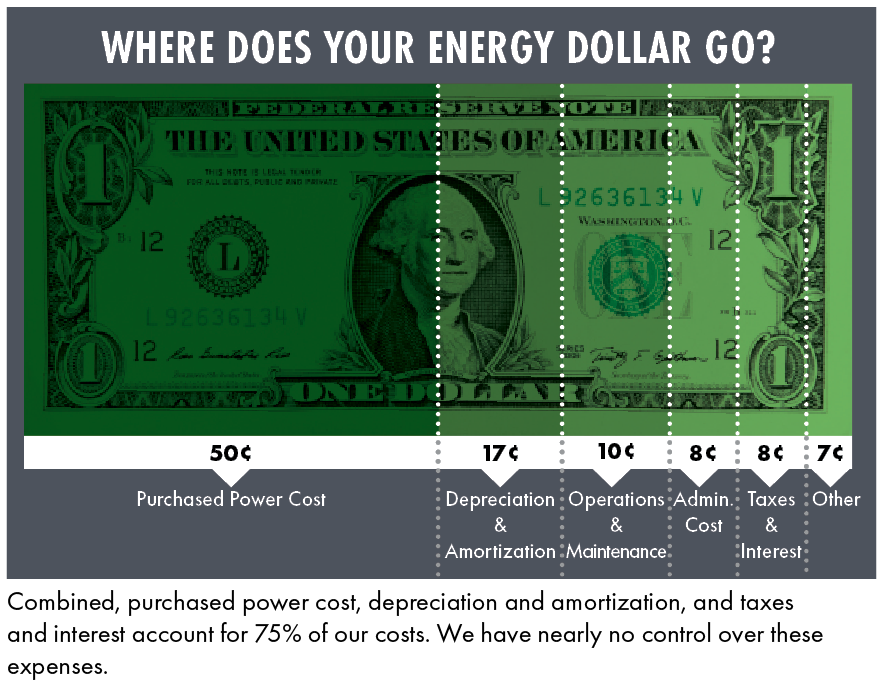

I often hear people suggest payroll, programs and facilities as opportunities for savings. These items only make up about 14% of our budget. Cutting them would make little difference in the size of your bill, but would greatly impact your service reliability and restoration time during power outages.

Instead, it’s the portion of our budget we can’t control that’s driving costs: purchased power, the cost of financing, taxes and interest.

We have cut back in every possible area without sacrificing reliability. The fact that we have held rates relatively steady despite escalating costs is a testament to the Board and staff’s ability to manage your resources efficiently. It just isn’t enough. We must make changes to our rates to not only cover our expenses but also satisfy the requirements of our lenders and remain financially viable in the long term.

The bottom line

After prayerful consideration, the Board approved new rate schedules that went into effect April 1. The impact will vary depending on individual usage habits, but the average monthly increase for residential members is about $24.

We offer ways to help members manage electric bills, including rate plan options, assistance in lowering usage and demand, rebates for upgrading to high-efficiency heat pumps, and payment options.

I appreciate your trust and look forward to serving you in every way possible.